5 Essential Strategies for Buyers Navigating Today's Evolving Housing Market

The housing market in late 2025 presents a unique landscape of opportunity and challenge. With mortgage rates experiencing significant volatility and recently dropping to their lowest levels in three years, buyers face a market in transition. Current conditions show promise: 30-year fixed mortgage r

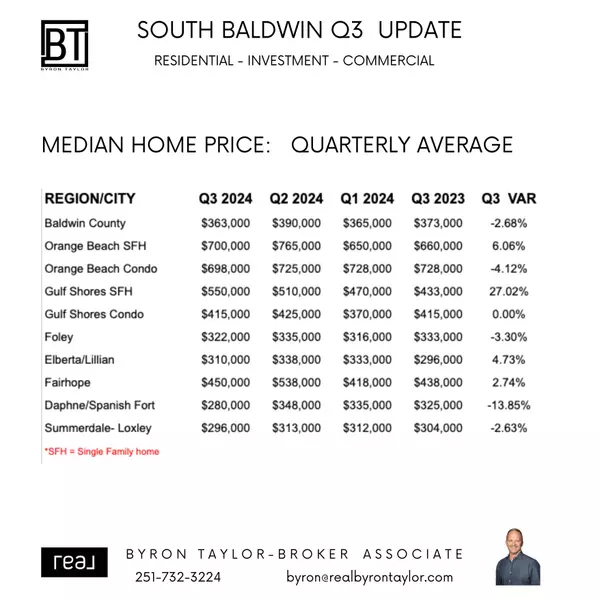

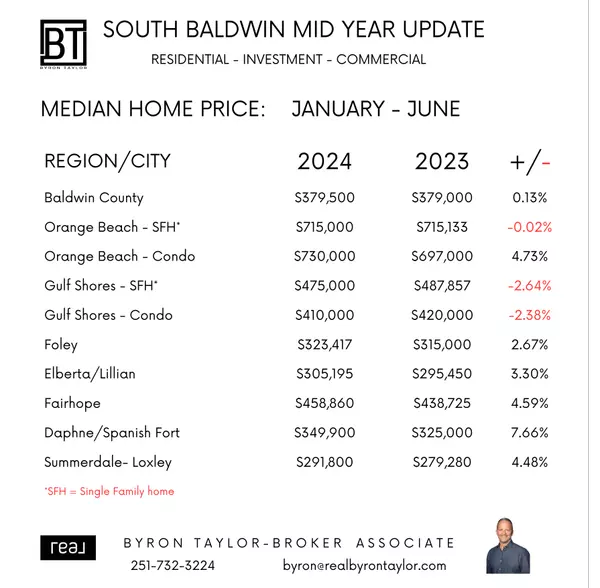

South Baldwin County February 2025 Market Update

After our once in a hundred years surprise of snow, South Baldwin County weather is back to normal and we are enjoying 60-70 degree weather in February. After 17 years in the northeast, this is what I moved down here for and probably why many of you are thinking about making the same move.

3 Reasons To Buy a Home Before Spring

Let’s face it — buying a home can feel like a challenge with today’s mortgage rates. You might even be thinking, “Should I just wait until spring when more homes hit the market and rates might be lower?” But here’s the thing, no one knows for sure where mortgage rates will go from here, and waitin

Categories

Recent Posts